hawaii capital gains tax rate 2021

Hawaii exempts 16 of income through pension disbursements Wages salaries 73 Pensions IRA distributions 12 Self-employment income 6 Social security 4 Captital gains 3 Interest dividends 2 Composition of federal Individual Income in Hawaii Income Source Rate. Discover 2021 Federal Capital Gains Tax Brackets for getting more useful information about real estate apartment mortgages near you.

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets.

. Increases the capital gains tax threshold from 725 per cent to 9 per cent. 1 increases the Hawaii income tax rate on capital gains from 725 to 9. Short-term capital gains come from assets held for under a year.

Capital Gains Losses Form N-40 Schedule D Form N-40 Rev 2021 Capital Gains and Losses Clear Form SCHEDULE D FORM N-40 REV. Tax brackets for capital gains in the. Increases the alternative capital gains tax for corporations from 4 to 5.

Effective for tax years beginning after 12312020. Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate.

Hawaiis capital gains tax rate is 725. According to the World Population Review California has the highest capital gains tax at 1330 which is closely followed by Hawaii with an 1100 capital gains tax rate. What Is The Capital Gains Rate For 2021.

For those earning more than. Short-term capital gains are taxed at the full income tax rates listed above. 2021 STATE OF HAWAIIDEPARTMENT OF TAXATION Capital Gains and Losses 2021 Attach this Schedule to Fiduciary Income Tax Return Form N-40 Name of Estate or Trust PART I N40SCHD_I 2021A 01 VID01 Federal Employer.

Long-term capital gains come from assets held for over a year. If youre married filing taxes jointly theres a tax rate of 14 from 0 to 4800. 2021 Hawaii State Sales Tax Rates The list below details the localities in Hawaii with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Capital Gains Tax in Hawaii. That applies to both long- and short-term capital gains. Based on filing status and taxable income long-term capital gains.

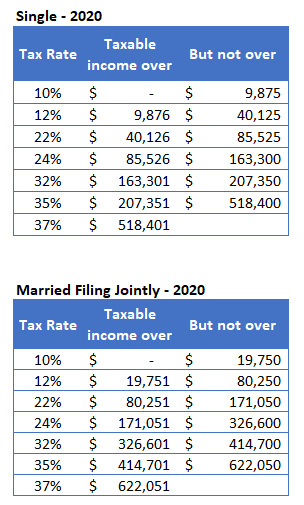

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. As an example if an individuals taxable income falls below 40400 for the year 2021 the individual wont have to pay capital gains tax. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year.

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed above. Increases the alternative capital gains tax for corporations from 4 to 5.

Applies for tax years beginning after. While it is quite easy to search the general capital gains tax of each state it is advisable to use a real estate capital gains tax calculator for ease and accuracy. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

Long-term gains are those realized in more than one year. Long Term Capital Gains Tax Brackets for 2021 It should also be noted that taxpayers whose adjusted gross income is in excess of 200000 single filers or heads of household or 250000 joint filers may be subject to an additional 38 tax as a net investment income tax. Increases the capital gains tax threshold from 725 to 9.

There is currently a bill that if passed would increase the capital gains tax in Hawaii to 1100 and would also increase the states income tax. 4 rows How Are Short Term Capital Gains Taxed In 2021. Tax on capital gains would be raised to 288 percent according to House Democrats.

In Hawaii theres a tax rate of 14 on the first 0 to 2400 of income for single or married filing taxes separately. 36 37a Net capital gain taxable to the estate or trust. The bill has a defective effective date of July 1 2050.

States With the Highest Capital Gains Tax Rates. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. House members take their oaths of.

The capital gains rate will be 15 percent on income between 40401 and 445850 however. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains 36 Enter your taxable income from Form N-40 line 22. Applies for tax years beginning after 12312020. SD1 2021-12-10 Carried over to 2022 Regular Session.

The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data. Capital gains tax rates on most assets held for less than a.

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

2021 Capital Gains Tax Rates By State Smartasset

The States With The Highest Capital Gains Tax Rates The Motley Fool

York Maine States Preparedness

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

How High Are Capital Gains Taxes In Your State Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

How Do State And Local Sales Taxes Work Tax Policy Center

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

How Do State And Local Individual Income Taxes Work Tax Policy Center

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com